Rules for Incremental Reward for R&D Funds for High-tech Enterprises in Hainan Province

- TropicalHainan

- Site Admin

- Posts: 280

- Joined: Tue May 18, 2021 5:36 am

Rules for Incremental Reward for R&D Funds for High-tech Enterprises in Hainan Province

Detailed rules for reward of R&D fund increment of high-tech enterprises in Hainan Province

Release time: 2021-08-17,

Source: Hainan Provincial Government Website

Detailed rules for reward of R&D fund increment of high-tech enterprises in Hainan Province

Article 1: in order to regulate the management of incremental incentives for R&D expenses of high-tech enterprises, these rules are formulated in accordance with the Interim Measures for the Management of Special Funds for the Development of High-Tech Industries in Hainan Province.

Article 2: the subsidy funds mentioned in these Detailed Rules refer to the funds in the special funds for the development of high-tech industries arranged by provincial finances.

The budget of the provincial science and technology management department is used to support the incremental reward of R&D expenditures for high-tech enterprises (including high-tech enterprise cultivation Library enterprises).

Article 3: the Provincial Department of science and technology shall be responsible for the management of the subsidy funds, organize the application, review and summary of special allocating funds, and prepare funding plans; supervise and inspect the use of subsidy funds, carry out performance evaluation and later management. The science and technology management departments of all cities and counties are responsible for the acceptance of fund applications, preliminary examination, application to the Provincial Department of science and technology, fund allocation, cooperation with the Provincial Department of science and technology in the supervision and management of funds, etc.

Article 4: the incremental reward standard for R&D funds for high-tech enterprises (including incubator enterprises) shall be implemented in accordance with several policies of Hainan Province to support the development of high-tech enterprises (Trial) (Qiongfu [2020] No. 50) and the three-year action plan of Hainan Province for scientific and technological innovation (2021-2023).

Article 5: the R&D expenses shall be subject to the "deduction of R&D expenses" in the enterprise income tax return, and increment is calculated based on the difference between the previous two years. The basis for the collection of R&D funds is the "Announcement of the State Administration of Taxation on Issues Concerning the Collection Scope of the Pre-tax Deduction of R&D Expenses" (State Administration of Taxation Announcement No. 40 of 2017).

When calculating the increment of R&D funds in the first two years, only the part of the enterprise's own R&D funds is calculated each year (that is, the total R&D expenditures deduct the R&D incentives for the company from the fiscal year). If an enterprise has completed the final settlement and payment before the declaration of several policies for supporting the development of high-tech enterprises in Hainan Province (Trial) and has not filled in the "R&D expenses that can be added and deducted" in the enterprise income tax return, the relevant data in the special audit report may prevail.

Article 6: application conditions for incremental reward of R&D funds of high-tech enterprises:

(1) the enterprise, in the year of applying for funds, is within the validity period of the high-tech enterprise.

(II) the enterprise shall fill in the statistical survey and annual development report as required within the validity period of the high-tech enterprise.

(III) in the first two years of applying for funds, the proportion of the total research and development expenses to the total sales revenue of the same period in each year shall meet the relevant requirements, as follows:

1. For companies with sales income less than 50 million yuan (inclusive), the proportion shall not be less than 5%

2. For enterprises with sales revenue of 50 million yuan to 200 million yuan (inclusive), the proportion shall not be less than 4%.

3. The proportion of enterprises with sales revenue of more than 200 million yuan is not less than 3%.

(IV) in the first two years of applying for funds, the R&D expenses shall be truthfully filled in the corporate income tax return each year.

(V) enterprises with annual application funds exceeding 50,000 yuan (inclusive) need to entrust professional institutions to conduct special audits on R&D investment funds in the previous two years, and the audit results should be consistent with the relevant data in the tax return.

(VI) Companies that apply for an annual fund of no more than 50,000 yuan should record their R&D project ledger, R&D project initiation documents, R&D investment detailed account (auxiliary account), and related R&D equipment procurement materials (contracts, invoices, transfer records) , Material procurement materials (including contracts, invoices, warehouse records, etc.) and other relevant data on R&D investment are sorted out for reference.

Article 7: The application process of allocating funds. The Provincial Department of Science and Technology issues a capital declaration notice, and the applicant company submits the relevant materials to the city and county Science and Technology Management Department. The city and county science and technology management department reviews the application materials based on the data provided by the taxation department, and then submits it to the Provincial Science and Technology Department for review. The Provincial Science and Technology Department publicizes the funds of the enterprises to be supported to the society through official websites and other media, and the publicity period is generally not less than 5 working days.

Article 8: the expenditure scope, supervision and management of subsidy funds shall be implemented in accordance with the Interim Measures for the management of special funds for the development of high and new technology industries in Hainan Province.

Article 9: High-tech enterprises that move in as a whole may apply for incremental R&D funding awards in accordance with regulations in the next year after they apply for move-in awards.

Article 10: the detailed rules shall be interpreted by the Provincial Department of science and technology.

Article 11: These Detailed Rules shall come into force on September 13, 2021 and shall be valid for three years.

Click HERE to REGISTER

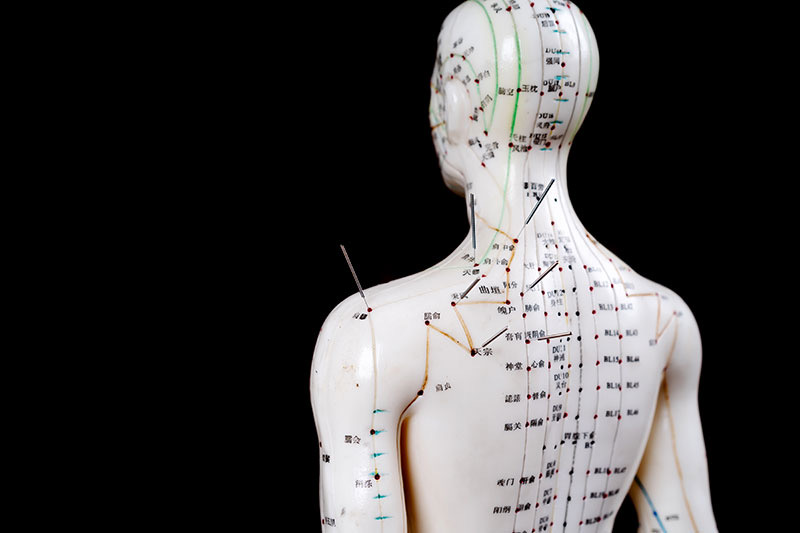

Hainan Medical Industry

Hainan Free Trade Port Policies

Key Parks and Investment guides