Hainan 2025 Trade Overview: What the Customs Data Shows

Overview

Based on official customs statistics, this article reviews Hainan’s foreign trade performance in 2025, focusing on changes in imports and exports, trade structure, and major partner trends.

Hainan’s 2025 foreign trade data shows overall stability with internal rebalancing.

Official statistics released by Haikou Customs in January 2026 indicate that total foreign trade value for 2025 was broadly unchanged compared with 2024. Within that headline, imports increased while exports declined, and the mix of trade modes shows meaningful movement.

All figures below are taken from the 2025 annual statistical tables published by Haikou Customs and compiled under the Guangzhou Customs system.

1. Overall Trade Performance in 2025

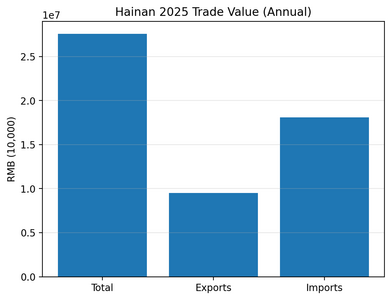

Total trade

- Total import and export value: 27,600,339.79 (RMB, 10,000)

- Year-on-year change: –0.68%

Exports

- Export value: 9,494,579.95 (RMB, 10,000)

- Year-on-year change: –10.62%

Imports

- Import value: 18,105,759.84 (RMB, 10,000)

- Year-on-year change: +5.48%

The headline picture is a broadly stable total for the year, with a clear divergence between imports and exports. Based on customs statistics, this indicates a change in the composition of trade flows.

Chart 1 (annual totals)

2. Monthly Performance Pattern

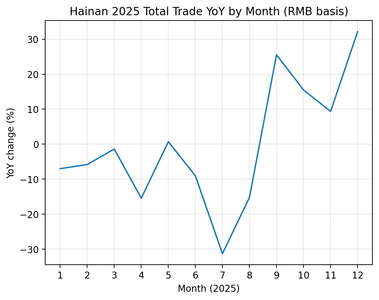

Trade performance varied across the year.

Selected monthly year-on-year changes in total trade:

- March: –1.4%

- April: –15.44%

- July: –31.29%

- September: +25.53%

- October: +15.49%

- December: +32.15%

The second half of the year, and particularly the fourth quarter, showed a notable year-on-year increase compared with earlier months. This indicates that 2025 performance was uneven across the year, rather than moving in a single direction month after month.

Chart 2 (monthly YoY line).

3. Enterprise Structure: Who Is Trading

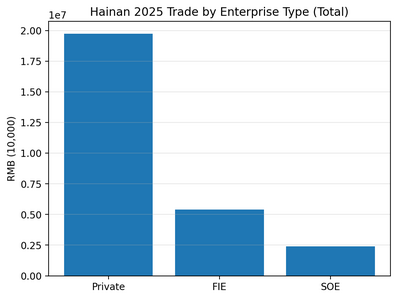

Trade by enterprise type shows a strong concentration in private-sector activity.

Share of total trade by enterprise type

- Private enterprises: approximately 71.6%

- Foreign-invested enterprises: approximately 19.6%

- State-owned enterprises: approximately 8.7%

Year-on-year performance

Private enterprises

- Total trade: +11.46%

- Exports: +16.30%

- Imports: +9.18%

Foreign-invested enterprises

- Total trade: –9.62%

- Exports: –30.83%

- Imports: +32.33%

State-owned enterprises

- Total trade: –40.31%

- Exports: –86.94%

- Imports: –26.36%

These figures indicate that private enterprises account for the largest share of Hainan’s recorded trade value in the customs tables, while foreign-invested enterprises were more active on the import side than the export side in 2025.

Chart 3 (enterprise totals)

4. Trade Mode: Composition Shift in the Data

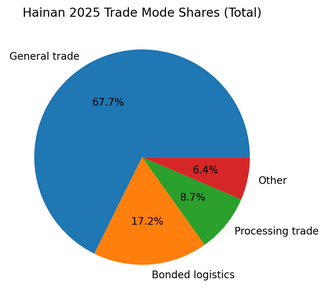

Trade by mode (share of total)

- General trade: approximately 67.7%

- Bonded logistics: approximately 17.2%

- Processing trade: approximately 8.7%

- Other trade types: approximately 6.4%

Year-on-year changes

General trade

- Total: –5.70%

- Exports: –11.43%

- Imports: –1.85%

Bonded logistics

- Total: +16.33%

- Exports: –29.18%

- Imports: +45.59%

Processing trade

- Total: +13.40%

- Exports: +14.14%

- Imports: +12.77%

Bonded logistics imports increased significantly year-on-year, which is one of the clearest structural signals in the 2025 tables. This is consistent with a higher share of logistics-linked activity reflected in the trade mode breakdown.

Chart 4 (trade mode shares).

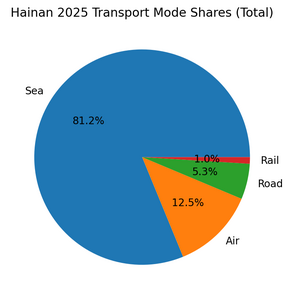

5. Transport Mode: How Goods Are Moving

Share of total trade by transport mode

- Sea transport: approximately 79.1%

- Air transport: approximately 12.2%

- Road transport: approximately 5.2%

- Rail transport: approximately 1.0%

Year-on-year changes

Sea transport

- Total: +3.02%

Air transport

- Total: +1.35%

- Imports: +20.97%

- Exports: –37.99%

Rail transport

- Total: +83.47%

- Imports: +114.43%

Sea transport remains the dominant channel by value in the customs tables. Air transport growth is driven primarily by imports, and rail transport remains a small share but shows rapid year-on-year growth from a low base.

Chart 5 (transport mode shares)

6. Major Trading Partners

Top trading partners by total trade value in 2025:

- Australia: 3,508,098 million RMB, +8.32%

- United States: 1,428,381 million RMB, –2.00%

- Indonesia: 1,295,323 million RMB, –9.64%

- Russia: 1,067,741 million RMB, –36.63%

- Vietnam: 1,012,244 million RMB, –2.97%

- United Arab Emirates: 949,981 million RMB, –11.46%

- Hong Kong (China): 934,535 million RMB, –30.51%

- Oman: 859,478 million RMB, +28.79%

- Canada: 791,294 million RMB, –1.54%

- Brazil: 772,891 million RMB, –20.54%

These partner rankings reflect diversification across commodity suppliers, regional markets, and major economies, as recorded in the customs partner table. This section does not include regional aggregates that are not explicitly published in the partner table.

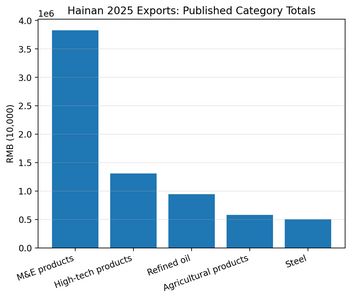

7. Product Structure: What Was Traded

The product tables list published category totals and their year-on-year changes. Shares below are calculated using the published annual totals and rounded.

Main export categories (selected published category totals)

- Mechanical and electrical products: 40.3% of exports, –17.82%

- High-tech products: 13.8%, –39.39%

- Refined oil products: 10.0%, –34.42%

- Agricultural products: 6.1%, +0.95%

- Steel products: 5.3%, +24.37%

- Food products: 5.3%, –4.26%

Chart 6 (exports)

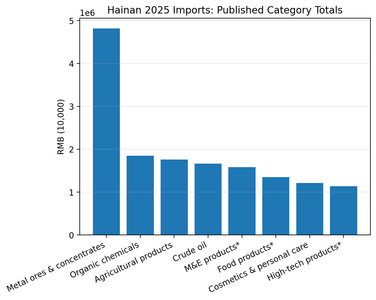

Main import categories (selected published category totals)

- Metal ores and concentrates: 26.6% of total imports, +9.36%

- Organic chemicals: 10.2% of total imports, –3.06%

- Agricultural products: 9.7% of total imports, +18.74%

- Crude oil: 9.2% of total imports, up 296.40% year-on-year

- Mechanical and electrical products: 8.7% of total imports, +44.52%

- Food products: 7.4% of total imports, +12.28%

- Cosmetics and personal care products: 6.7% of total imports, +4.85%

- High-tech products: 6.3% of total imports, +64.66%

Taken together, the tables show a contrast between declining export values across several major published export categories and increasing values across multiple major import categories, particularly energy-related items, industrial inputs, and consumer-related goods.

Chart 7 (imports)

8. What Changed, and What Did Not

What changed in 2025

- Imports accounted for the increase in total trade value while exports declined

- Bonded logistics trade volumes increased significantly year-on-year

- Import structure shows diversification across multiple major categories

- Export values declined across many published categories in the customs tables

What did not change

- Private enterprises remain the largest trade actors by value in the tables

- Sea transport remains the dominant channel by value

- Trade remains concentrated in a limited number of major product groups

- The trade structure reflected in the tables shows a high share of import-oriented and logistics-linked activity

9. Practical Takeaways

For businesses:

- The tables show higher growth rates in logistics-related and bonded-logistics categories

- Import categories include several segments with strong year-on-year growth in 2025

- Where operations involve bonded logistics, classification, documentation, and compliance processes remain important, and binding decisions should be made with licensed local professionals

For observers and planners:

- The customs tables show changes in trade composition rather than a uniform decline in trade values

- Trade patterns in the customs data show a high share of logistics-linked activity

- The customs tables do not show abrupt changes in the distribution of trade modes or transport shares within the year, although monthly volatility is visible

Data Notes

- Source: Haikou Customs annual statistical tables, published January 19, 2026

- Units: values in RMB (10,000) as presented in the tables; percentages rounded

- Data scope: import and export activity of Hainan-registered enterprises

- City-level data reflects enterprise registration location, not physical cargo flow

- Figures are subject to revision by customs authorities

- This analysis is descriptive and does not constitute legal, tax, accounting, or investment advice; for binding decisions, consult licensed PRC legal and professional advisors

-

Hainan Trade Deep Dive – January 2026

1 week ago

-

Hainan Trade Deep Dive – December 2025

1 month ago

-

Hainan Trade Deep Dive – November 2025

3 months ago

-

Hainan Trade Deep Dive – October 2025

4 months ago

-

Hainan Province Releases Economic Data for the First Half of 2025

4 months ago