Hainan Company Setup Guide

Hainan Island Free Trade Port offers many opportunities for international business owners looking to set up a new company or open a branch of an existing international company. However, the process can be complex and, in all probability, will require local assistance. This article provides a detailed guide on what to expect when setting up a business in Hainan Island Free Trade Port.

Before you embark on your journey of setting up a company in Hainan, you’ll need to consider whether your industry is encouraged or on the negative list.

Hainan Island Free Trade Port encouraged industries.

The “newly encouraged industries in Hainan Free Trade Port” are divided into 14 categories, namely:

1. Agriculture

2. Forestry

3. Animal husbandry

4. Fishery

5. Manufacturing

6. Construction

7. Wholesale and retail

8. Transportation, storage and postal industry

9. Accommodation and catering industry

10. Information transmission, software and information technology service industry

11. Financial industry

12. Leasing and business service industry

13. Scientific research and technical service industry

14. Water conservancy, environment and public facilities management industry, education, health and social work, culture, sports and entertainment industry.

Additionally, the Hainan Free Trade Port is striving to foster high-tech industries revolving around the internet-of-things, artificial intelligence and blockchain and digital trade.

The Hainan Free Trade Port Negative list

The Hainan Free Trade Port has a negative list for foreign investment access that was released by the National Development and Reform Commission and the Ministry of Commerce on December 31st, 2020. The list contains 27 items, compared to the 31-item national negative list which came into effect on January 1st 2022. Additionally, The “Special Administrative Measures for Cross-border Service Trade in the Hainan Free Trade Port” (Negative List) (2021 Edition) came into effect on, August 26th.

Negative lists specify the sectors where foreign investment is restricted or prohibited, while sectors not on the list are open to foreign investment.

Read more: How does the Hainan Free Trade Port negative list compare to other FTZ negative lists?

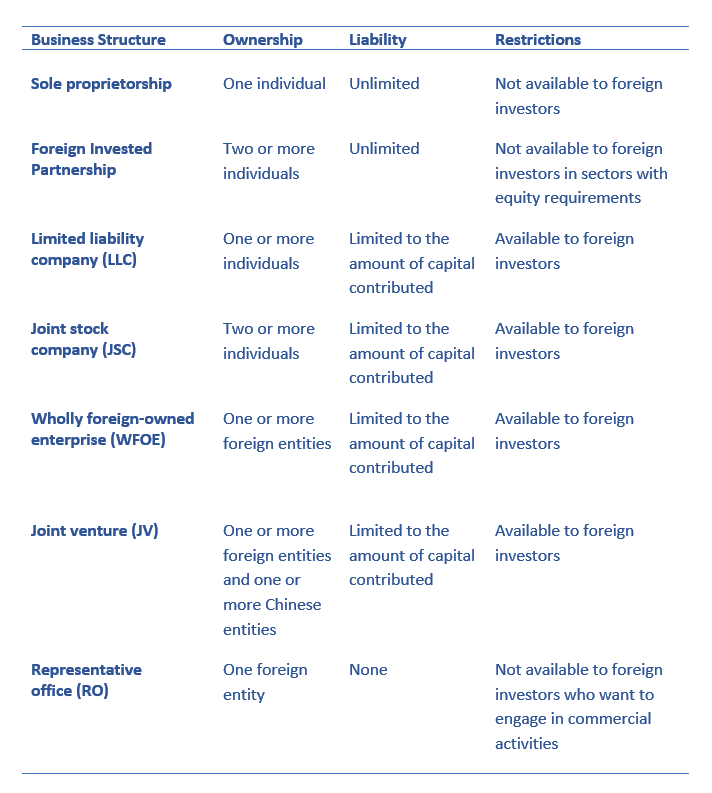

Choosing the Right Business Structure

The various types of companies foreign investors are allowed to establish in the Hainan Free Trade Port, are as follows;

Limited liability company

Joint stock company

Foreign-invested enterprise

Other business structures

The specific type of company that is most suitable for a foreign investor will depend on various factors such as the nature of the business, the level of control desired by the foreign investor, and the specific requirements of the business.

Choosing a Location for Your Hainan Business

Hainan Island unveiled 11 key industrial parks on June 3rd, 2020 to promote the construction of the Hainan Free Trade Port (FTP). The 11 key parks around the island cover three major fields: tourism, modern services, and advanced technologies. As important carriers and platforms for the construction of the Hainan Free Trade Port, the key parks are the main incubators to implement Hainan FTP policies. A key goal of the 11 parks is to make full use of the advantages of institutional innovations, take the lead in implementing relevant policies and conducting stress tests, as well as accelerate the innovative development of Hainan FTP.

Hainan Industrial Parks: A Guide to the 11 Key Parks

Yangpu Economic Development Zone (including Hainan Dongfang Industrial Park and Jinpai Port Economic Development Zone),

Bo’ao Lecheng International Medical Tourism Pilot Zone,

Haikou National High-tech Industrial Development Zone,

Haikou Integrated Free Trade Zone,

Sanya Yazhou Bay Science and Technology City,

Sanya Central Business District,

Wenchang International Aerospace City,

Lingshui Li’an International Education Innovation Experimental Zone,

Hainan Resort Software Community, and

Fullsing Town Internet Innovation Park.

Read more: A complete guide to the 11 industrial Parks in the Hainan Free Trade Port

How long does it take to set up a company in the Hainan Free Trade Port?

The time it takes to set up a company in the Hainan Free Trade Port can vary depending on several factors, such as the type of company being set up, the industry it operates in, and the specific requirements of the local authorities. In general, you should consider that it takes approximately 1 month to register a Consulting Free-Trade Port company in Hainan. For a Trading Free-Trade Zone company, it can take up to 1.5 months. The key industrial parks have streamlined the procedure and most of the process can be done under one roof.

However, please note that this is an approximate time frame, and the actual time may vary depending on various factors such as the specific requirements of the business and the efficiency of the relevant government departments. It is always a good idea to allow for some extra time when planning the process of setting up a business.

Hiring a local sponsor to help set up your international company in the Hainan Free Trade Port.

If you’re not setting up in one of the 11 key parks, foreign investors are strongly recommended to retain a Chinese entity that is authorized or permitted by relevant authorities to directly submit the application documents.

Hiring a local company as a sponsor can provide valuable guidance and assistance in navigating the process of setting up a business in Hainan Island Free Trade Port. They can help with tasks such as preparing and submitting the necessary documents, communicating with the relevant government departments, and ensuring that all requirements are met as well as translation and interpreter services.

Obtaining the required licenses and permits

Step 1: Name Registration

Foreign investors must register the name of their company with the Administration for Market Regulation (市场监督管理局) office in Hainan Free-Trade port.

web: https://amr.hainan.gov.cn/

Tel: 0898-66767973 (Consumer consultation)

Hainan Commercial Registration Consultation Telephone: 4007965656

An example of what a company name in Chinese might look like to comply with the Chinese company registration laws.

The company name must be in Chinese and must follow the rules set up in Chinese company registration laws. The company name must include the company industry or brand, operating region of the business, and a suffix of “Company Limited”. It is important to choose a name that is unique and compliant with the regulations.

An example of a company name using “My Company” as an example could be “海南我的公司有限公司” (Hǎinán wǒ de gōngsī yǒuxiàn gōngsī), “Hainan My Company Co., Ltd.”.

The name includes the operating region of the business (海南 Hǎinán), the company industry or brand (我的公司 wǒ de gōngsī), “My Company”, and a suffix of “Company Limited” (有限公司 yǒuxiàn gōngsī). It is important to note that this is just an example and the specific requirements for a company name may vary depending on various factors such as the nature of the business and the specific requirements of the relevant government departments.

Step 2: Obtaining a Certificate of Approval (COA)

Once the company name has been approved by Administration for Market Regulation (市场监督管理局) office in the Hainan Free-Trade port, the next step is to obtain a Certificate of Approval (COA). This certificate is issued by the Market Regulation Office and confirms that the company has met all the necessary requirements for registration.

To obtain a COA, Foreign invested enterprises (FIEs) must submit an application to the Hainan Provincial Administration for Market Regulation (HPAMR). The application must include the following information:

• Name of the Business (As previously approved)

• Registered Office Address of the Business

• ID of the Legal Representative

• ID of the Company Supervisor

• Shareholder and Directors Information

• Notary Documents of the Shareholders

• Articles of Association and Memorandum of Association

• Registered Capital of the Company

• Feasibility Study along with Budget, (if required)

The HPAMR will then review the application and issue a COA if it is approved. The COA is valid for a period of five years and can be renewed.

Step 3: Apply for Business License

After obtaining the Certificate of Approval, the next step is to apply for a Business License. This license is required for the company to legally operate in Hainan Island Free Trade Port. The documents you’ll need to apply for the license are;

- An application form.

- The Articles of Association.

- The newly-acquired Certificate of Approval and

- The name of the company in Chinese, pre-approved by the HPAMR.

- Depending on the nature and scope of the business other documents may be required.

Step 4: Have Chops Made

Once the Business License has been obtained, the next step is to have chops made by the Public Security Bureau (PSB).

Address: Dongsan Street, Changbin Road, Xiuying District, Haikou

Tel: +86-898-68590746

Chops are official seals that are used to authenticate documents and contracts. Chops, also known as seals or stamps, are an essential part of doing business in China. They are used to legally authorize documents, often in place of a signature. The importance of seals comes from a historical mistrust of signatures as a result of the study of calligraphy and the number of forgeries that could occur.

While chops do not play a role in western business practices, it’s important to understand that, in China, whoever holds the ‘company chops’ holds the keys to the company.

There are several different types of chops, each with a different use;

- Official company chop: This chop is required when any important document is signed and has the widest scope of use among all stamps.

- Financial chop: This chop is used for opening a bank account, authenticating financial documents (such as tax filings), issuing checks and most bank-related transactions.

- Contract chop

- Invoice chop

- Customs chop and even,

- Electronic chop

Step 5: The next step is to obtain a Tax Certificate from the Taxation Bureau.

The National Tax General Bureau Haikou Tax Bureau Zhongshan South Rd Self-Service Tax Service Hall is located at 58-2 Zhong Shan Nan Lu, 58, Qiongshan District, Haikou.

This certificate confirms that the company has registered with the Taxation Bureau and is authorized to conduct business in Hainan Island Free Trade Port.

To apply for a Tax Certificate from the Taxation Bureau in Haikou to finish setting up your business, you will generally need to provide the following documents:

- Business License: This is the legal document that certifies your business entity. You should obtain this document from the relevant administrative department responsible for business registration.

- Proof of Identity: You will need to provide your personal identification documents, such as your passport.

- Proof of Address: This can be in the form of a utility bill, lease agreement, or any other document that verifies your business address.

- Articles of Association: If your business is registered as a company, you should submit the Articles of Association, which outlines the internal regulations and structure of your company.

- Bank Account Opening Certificate: Obtain a certificate or confirmation from the bank where you have opened a business bank account. This document verifies your business’s banking details.

- Approval Documents: Depending on the nature of your business, you may need to provide additional approval documents or permits specific to your industry. For example, if you are operating in a regulated sector, you might need licenses or certificates related to that sector.

- Previous Tax Certificates (if applicable): If you have been running a business before or have any previous tax obligations, you might be required to provide previous tax certificates or relevant tax documents.

- Other Supporting Documents: The taxation bureau may request additional documents or information based on the specific requirements of your business or local regulations. It is advisable to consult with the local taxation bureau or seek professional advice to ensure you have all the necessary documents.

Step 6: Register with State Administration of Foreign Exchange

In China, the State Administration of Foreign Exchange (SAFE) is responsible for the administration of foreign exchange transactions. If your company engages in foreign exchange activities, such as foreign currency transactions, foreign debt, or cross-border capital flows, you may need to register with SAFE.

The specific registration requirements with SAFE depend on the nature of your business activities and the amount of foreign exchange involved. Here are a few common scenarios that may require registration:

- Foreign Currency Account Opening: If your company needs to open a foreign currency account, you will typically need to register with SAFE. This registration process allows you to convert and transfer funds in foreign currencies.

- Foreign Debt: If your company plans to obtain foreign loans or issue foreign bonds, you may need to register with SAFE for foreign debt-related transactions.

- Cross-border Capital Flows: If your company engages in significant cross-border capital flows, such as inbound or outbound investments, repatriation of profits, or capital injections, registration with SAFE may be required.

- Other Foreign Exchange Activities: Depending on the specific regulations and policies in the Hainan Free Trade Port, there may be additional foreign exchange activities that require registration with SAFE. It is advisable to consult with a local professional or directly contact the SAFE office for guidance.

Remember that compliance with foreign exchange regulations is crucial, and failure to comply can result in penalties or other legal consequences. Therefore, it is recommended to seek professional advice or contact the SAFE office to understand the specific requirements and procedures for your company. You can find out more about SAFE in Hainan here; https://www.safe.gov.cn/hainan/index.html

Business hours:

Monday to Friday (except legal holidays)

8:30 am to 12:00 noon

Office location:

Hainan Branch of the Administration of Foreign Exchange, No. 83, Binhai Avenue, Longhua District, Haikou City

Setting up a business in the Hainan Island Free Trade Port involves several steps and will almost certainly require local assistance. By following this guide and considering all relevant factors, international business owners can successfully set up a company in Hainan Island Free Trade Port and take advantage of the many opportunities it offers.

Related article: Documents and Process for Registration of Foreign-Funded Companies in Hainan Island, China