[Tourism & Hospitality] China Duty Free Group: Strategic Market Entry into Hainan’s Free Trade Port

- This topic has 0 replies, 1 voice, and was last updated 2 weeks ago by .

-

Topic

-

Executive Summary

China Duty Free Group (CDFG) transformed from a modest domestic operator into the world’s second-largest travel retailer through strategic expansion in Hainan Free Trade Port. Despite recent market volatility, the company’s ambitious infrastructure investments and strong market position offer critical insights for businesses considering large-scale entries in policy-supported environments.

Company BackgroundCompany ProfileCDFG, a subsidiary of China Tourism Group, operates as China’s dominant duty-free retailer, partnering with over 800 global and domestic brands at its flagship Haikou complex. This leadership was cemented by the October 28, 2022 opening of the cdf Haikou International Duty Free City, the world’s largest standalone duty-free facility by floor area at roughly 280,000 sqm.

Pre-Entry PositionBy 2010, CDFG recorded RMB 2.7 billion in duty-free sales (US$417 million) and RMB 130.7 million in duty-paid sales, earning a global ranking of 19th with €329 million in total turnover. Its transformation accelerated following the April 20, 2011 launch of Hainan’s pilot offshore duty-free policy, unleashing new travel-retail opportunities.

Market Entry Strategy and Investment ScaleInfrastructure InvestmentRather than disclosing exact capital outlay, CDFG’s Haikou complex is estimated to have cost in the low-billion-dollar range to develop, covering around 280,000 sqm and establishing it as the largest standalone duty-free retail venue globally.

Policy LeverageCDFG strategically aligned with key Hainan Free Trade Port policies, securing:

• A duty-free shopping quota increase from RMB 30,000 to RMB 100,000 per person per year (effective July 1, 2020)

• A 15% corporate income tax rate for qualifying enterprises in encouraged industries

• Zero-tariff treatment (duties, VAT, consumption tax) on all imports to Hainan by 2025 under the FTP master plan

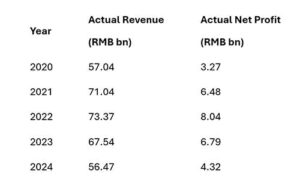

Challenges Faced and Market RealitiesRevenue VolatilityCDFG’s revenue swung from RMB 67.54 billion in 2023 to RMB 56.47 billion in 2024 (–16.4%), while net profit fell 36.3% to RMB 4.32 billion in 2024.

Market CompetitionAs new players entered post-2020, CDFG’s Hainan market share softened slightly but remained above 80% by 2024, down marginally from its peak dominance earlier in the decade.

Economic HeadwindsHainan duty-free sales declined almost 30% in 2024, and shopper numbers fell by about 16% to 5.68 million, reflecting broader shifts in Chinese consumer sentiment and competition from overseas destinations such as Japan.

Solutions ImplementedScale and Premium PositioningUnder its “first-store economy” initiative, CDFG secured exclusive brand debuts, including Coach’s first two-storey travel-retail flagship in China, reinforcing a premium shopping experience.

Diversification Strategy• Secured 10 new airport and port duty-free concessions in 2024

• Expanded internationally with new outlets in Singapore, Hong Kong, Tokyo, and Sri Lanka

• Launched 12 downtown duty-free projects across major Chinese cities under new policy incentives

Digital IntegrationCDFG built a comprehensive omnichannel platform, growing its membership base to 38 million and boosting both conversion rates and customer retention.

Current Status and Measurable OutcomesMarket Leadership MaintainedDespite 2024 headwinds, CDFG remains the world’s second-largest travel retailer by revenue and boasts a market capitalization of approximately €15.38 billion as of mid-2025.

Financial Performance• Gross profit margin: 30.72% in 2024

• Total assets: RMB 76.1 billion, per 2024 annual report disclosures

• Continued dividend payments: CNY 1.308 per share for 2024, underscoring financial resilience

Strategic PositioningCDFG has positioned itself as the primary beneficiary of China’s pivot from overseas duty-free shopping to Hainan-based purchases, capturing significant domestic consumption flows.

Key Lessons for Market Entry1. Policy Alignment Is Critical but VolatileGovernment incentives can drive rapid growth, yet advantages diminish as the market matures and competition intensifies.

2. Scale and Premium Positioning Outperform Cost-CuttingMaintaining large-scale, premium infrastructure investments enabled CDFG to capture share when conditions improved.

3. Timing and Market Cycles Are UnpredictableEven market leaders face cyclical downturns; robust risk planning is essential to navigate revenue volatility.

4. Diversification Provides ResilienceExpanding into airports, international markets, and downtown stores smoothed revenue swings when Hainan sales softened.

Investment Considerations for Similar Market Entries• Capital Requirements: Expect investments in the low-billion-dollar range for flagship retail complexes

• Timeline: Allocate 3–5 years for infrastructure development and policy rollout

• Policy Risk: Build operational flexibility to adapt as regulatory benefits evolve

• Market Volatility: Prepare for 20–30% revenue fluctuations in emerging retail destinations

• Competition Evolution: Initial market advantages erode as new entrants arrive

CDFG’s evolution underscores both the exceptional opportunities and inherent risks in policy-driven market entries. Success demands significant capital, strategic patience, and operational agility to thrive across market cycles.Updated vote successfully

- The forum ‘Market Entry Case Studies’ is closed to new topics and replies.