On June 4, 2025, China’s Ministry of Finance and the Ministry of Housing and Urban-Rural Development announced the selection of 20 cities to receive more than 20 billion yuan (approximately $2.78 billion) in central fiscal support for urban renewal.

The funding marks a major expansion of China’s national urban renewal strategy, first introduced at the 2019 Central Economic Work Conference and trialed in a 2024 pilot involving 15 cities.

How the Funding Works

The cities were selected through a competitive review process, following policy guidelines issued earlier in May 2025. The funding is distributed through a tiered subsidy system based on regional classifications defined by the policy, not traditional geography. Cities fall into one of three categories:

- Eastern cities – up to 800 million yuan (e.g., Suzhou, Xiamen)

- Central cities – up to 1 billion yuan (e.g., Zhengzhou, Changsha)

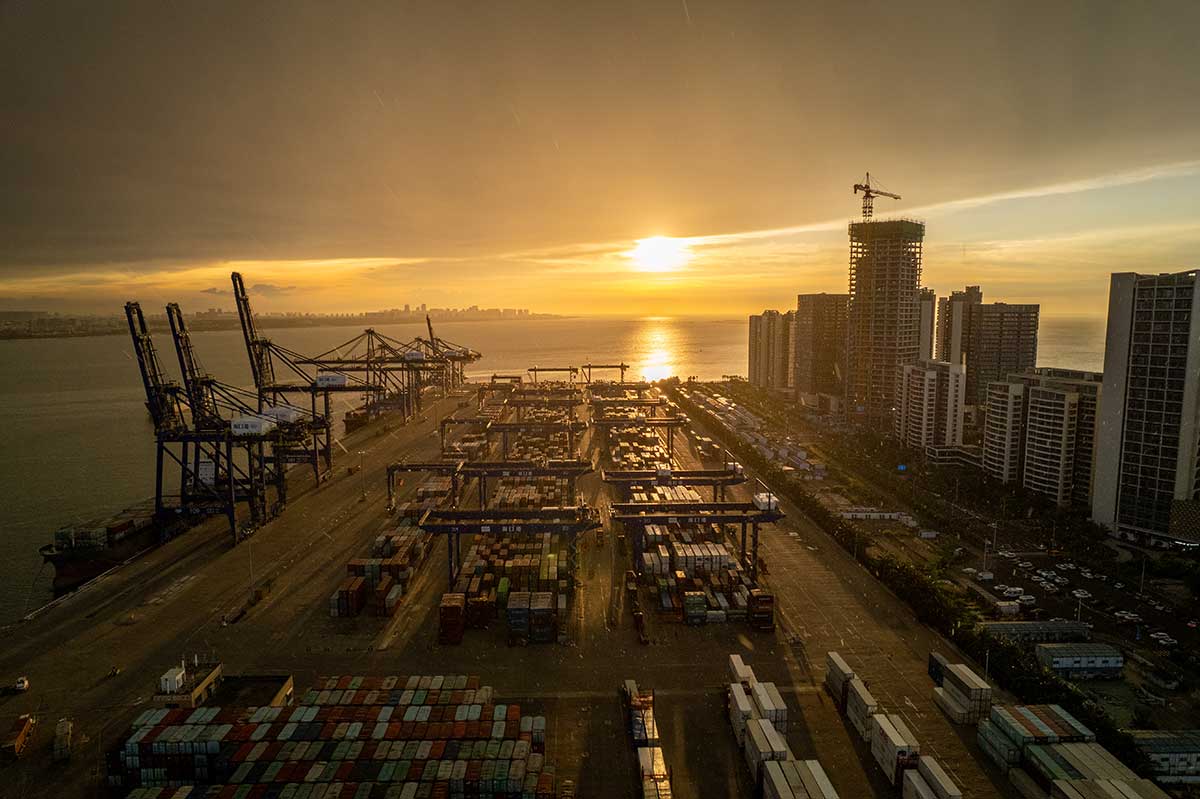

- Western cities and municipalities – up to 1.2 billion yuan (e.g., Haikou, Urumqi, Beijing, Tianjin, Harbin)

Notably, cities like Haikou and Dalian are classified under the “Western/municipality” tier for subsidy purposes despite their actual geographic locations.

Building on a Proven Framework

The program builds on the success of the 2024 pilot phase, during which 15 cities completed 60,000 projects with a combined investment of 2.9 trillion yuan (about $402.8 billion). Highlights included:

- Installation of 25,000 elevators in aging residential buildings

- Creation of 500,000 new parking spaces

- Development of 2,254 elderly care facilities

These results helped validate the shift from broad urban expansion to targeted renewal efforts.

How Cities Were Chosen

The 2025 city list reflects both economic strategy and social priorities. Selection focused on three key groups:

- Major cities along the Yellow and Pearl River basins – e.g., Guangzhou, Jinan

- High-growth third-tier cities – e.g., Yichang, Wuhu

- Border and minority-populated areas – e.g., Urumqi, Xining

Each group is meant to drive national development while addressing regional imbalances and supporting long-term cohesion.

| Category | Selected Cities | Max Subsidy | Reason |

| Eastern | Suzhou, Xiamen, Wenzhou, Jinan | 800 million yuan | Mature infrastructure, densification |

| Central | Zhengzhou, Changsha, Yichang, Wuhu | 1 billion yuan | Economic transformation, industrial base |

| Western/Municipalities | Haikou, Urumqi, Beijing, Tianjin, Harbin, Dalian | 1.2 billion yuan | Historical underinvestment |

Where the Money Goes

Urban renewal projects will prioritize:

Underground infrastructure

Utility upgrades: Suzhou’s “plant-network integration” sewage system now serves 98% of households.

Sponge city features: In Guangzhou, permeable roads and flood-retention tanks help mitigate extreme rainfall.

Waste management

Tianjin operates circular economy parks that process 500 tons of construction waste daily.

Cultural and commercial revitalization

In Harbin, historic Russian-era buildings are being repurposed into tourism and retail spaces.

Funding Mechanisms

In addition to central subsidies, local governments can tap into other sources:

Special-purpose bonds: 3.9 trillion yuan was allocated nationally in 2024 for infrastructure.

Public-private partnerships (PPPs): Encouraged as a supplementary financing tool, though no specific leverage targets are mandated.

Subsidies will be distributed annually and tied to project milestones to ensure accountability.

Governance and Innovation

The initiative also emphasizes modernization of city governance. For example:

- Xiamen uses 3D digital modeling to plan and coordinate infrastructure development.

- Chengdu implemented an app-based system that gathered over 120,000 citizen suggestions for park designs.

Clarifying the Framework

This policy does not follow traditional regional definitions. Instead, it classifies cities according to investment need and strategic value. For instance, although geographically southern, Haikou is placed in the “Western” category for funding purposes.

Related article: Hainan is Fast Becoming A Strategic Gateway for International Companies in the RCEP Market