Foreign nationals living in China long-term face a significant tax milestone in 2025, as many will hit the six-year residency threshold that triggers taxation on worldwide income.

Under China’s Individual Income Tax (IIT) law, the “Six-Year Rule” applies to non-domiciled individuals who have stayed in China for at least 183 days annually over six consecutive years, without a single 30-day break abroad. With stricter enforcement, digital monitoring, and mandatory global income reporting now in place, it’s essential for expats to understand the rule’s implications and plan accordingly.

China’s Six-Year Rule is a crucial provision in its Individual Income Tax (IIT) law that determines when foreign nationals become liable for tax on their worldwide income, not just income sourced within China. This rule is particularly relevant for expats and long-term foreign residents.

Key Updates and Clarifications for 2025

Recent developments in tax enforcement have introduced enhanced reporting requirements and digital tracking measures. Foreign nationals should be aware of stricter documentation rules and expanded digital tax filing tools.

Key Points of the Six-Year Rule

Tax Residency Threshold

Foreign nationals who do not have a domicile in China (i.e., their permanent home is outside China) are considered tax residents if they reside in China for 183 days or more in a calendar year.

Six Consecutive Years

If a non-domiciled foreign individual meets the 183-day threshold for six consecutive years, without leaving China for more than 30 consecutive days in any of those years, they become liable for Chinese tax on their worldwide income starting from the seventh year.

Resetting the Clock

If the individual leaves China for more than 30 consecutive days in any calendar year, the six-year count resets. The individual must then accumulate another six consecutive years before being subject to tax on worldwide income.

Scope of Global Income

Once the Six-Year Rule is triggered, all types of income, such as employment, investments, foreign salaries, and other overseas earnings, become taxable in China, regardless of where the income is paid or received.

Transition from China-Sourced to Worldwide Income

Before crossing the six-year threshold, foreign nationals are generally taxed only on China-sourced income, or in some cases, income paid by a China-based employer for work performed in China.

Recent Updates and Practical Implications

Enhanced Tracking & Documentation

Chinese tax authorities have expanded digital monitoring of residency status, using entry-exit records to track foreign nationals’ presence in China.

Expats must maintain proper documentation when resetting their six-year count to avoid unintended global taxation.

Stricter Reporting Requirements

Foreign nationals approaching their sixth consecutive year are now required to declare all global income sources in advance, even if exemptions apply.

Digital Tax Filing Expansion

China’s IIT app now provides alerts for expatriates nearing their six-year threshold, offering personalized tax filing guidance, (more on the IIT app at the end of the article).

Start Date for Six-Year Calculation

The six-year count officially began in 2019, meaning foreign nationals who have continuously resided in China since then should seek professional tax advice for their 2025 obligations.

Application of the Rule

Counting Days

- Each full 24-hour period spent in China counts as one day toward the 183-day threshold.

- If a foreign national spends fewer than 24 hours in China in a day, that day does not count.

Tax Year

- The Chinese tax year aligns with the calendar year (January 1 to December 31).

Example Scenario

If a foreign national has resided in China for at least 183 days each year from 2019 to 2024, and has not left China for more than 30 consecutive days in any of those years, then 2024 marks their sixth year. Starting in 2025, they will be subject to Chinese tax on their worldwide income.

Practical Tax Planning Strategies

Avoiding Global Taxation

Expats who wish to avoid Chinese tax on their worldwide income often plan a departure for more than 30 consecutive days in a calendar year to reset the six-year clock.

Reporting Obligations

Once subject to the six-year rule, foreign nationals must report and pay tax on all global income, not just income earned within China.

Exemptions & Tax Treaties

Double Taxation Agreements (DTAs) between China and other countries may affect the calculation of days and tax obligations. Expatriates should consult tax treaties for specific provisions.

Summary Table

| Residency Status | Taxable Income in China |

| ≤183 days, | Only China-sourced income |

| ≥183 days, | China-sourced income and certain foreign-sourced income paid by a China entity |

| ≥183 days, 6 consecutive years | Worldwide income, starting from the 7th year |

| >30 consecutive days outside China | Six-year count resets; worldwide income not taxed |

China’s Six-Year Rule is a critical consideration for foreign nationals living and working in China long-term. Recent tax enforcement measures and digital tracking systems make comprehensive tax planning essential for those approaching the six-year threshold.

Individual Income Tax (IIT) app

The Individual Income Tax (IIT) app is an official tax filing tool developed by China’s State Taxation Administration. It allows taxpayers, including expats, to manage their income tax filings, deductions, and refunds digitally.

What is the IIT App?

The IIT app simplifies annual tax return procedures for individuals in China.

It enables users to file tax returns, claim deductions, check tax records, and receive alerts about their tax status.

Foreign nationals can use it to track their residency status and ensure compliance with China’s Six-Year Rule, (the Individual Income Tax (IIT) app is in Chinese only).

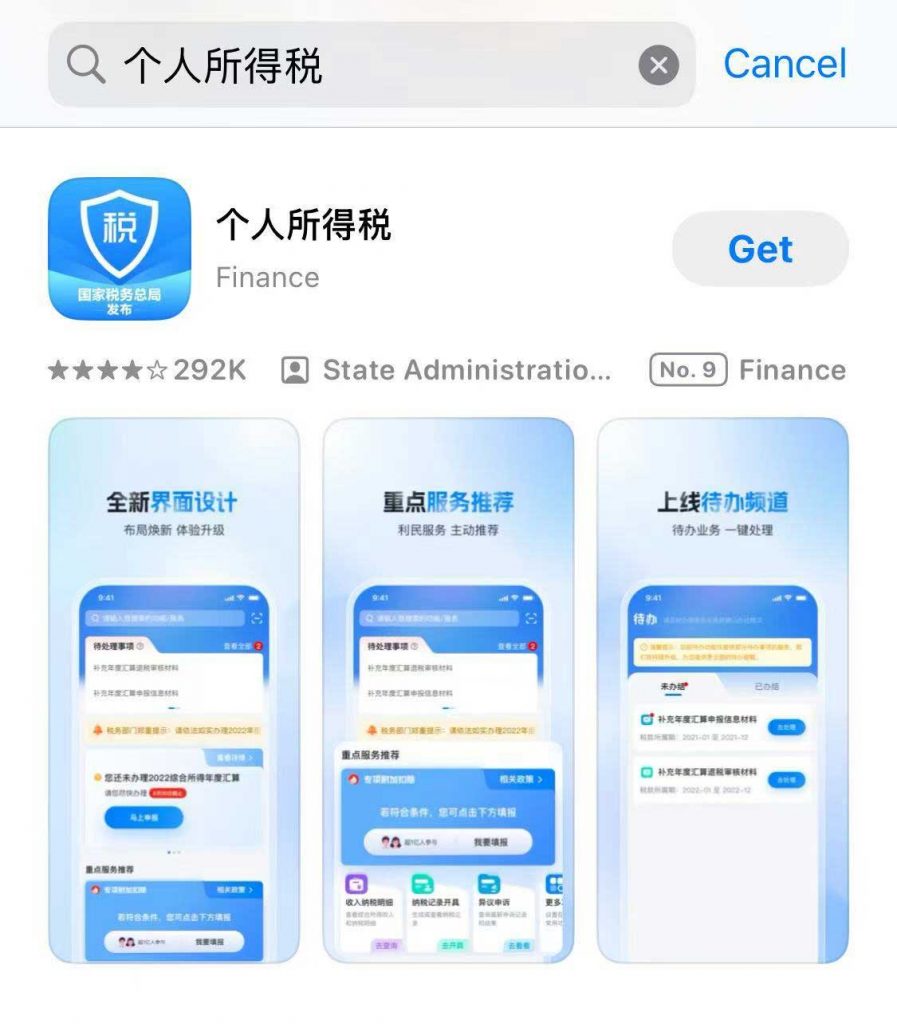

How Do I Download It?

Search for “个人所得税” (Individual Income Tax) in your app store (Apple App Store or Google Play).

Download and install the app.

Register using your passport details and obtain a tax registration code from the local tax bureau if required.

What Else Do I Need to Know?

Tax Record Access: You can generate official tax records for verification purposes.

Income Tax Details Inquiry: The app provides a breakdown of your taxable income and deductions.

Bank Card Binding: You may need to link a Chinese bank account for tax payments or refunds.

Expat-Specific Features: Foreign nationals can use the app to check their tax residency status and ensure compliance with China’s tax laws.

Related article: Hainan: Foreign companies can now engage in trade in services without setting up a Chinese business entity